Bachelor of Science inAccounting

Why STUDY ACCOUNTING AT ORU?

Our Bachelor of Science (B.S.) in Accounting provides a strong business foundation with specialized coursework to equip you for success in the dynamic world of finance. If you’re passionate about numbers, financial analysis, and business strategy, this program will prepare you for a thriving career in accounting, auditing, tax consulting, financial planning, and more.

Additional benefits include:

- High CPA Exam Success: ORU graduates consistently achieve top CPA exam pass rates.

- Fast-Track MBA Option: Meet the 150-hour CPA requirement with our five-year professional MBA program.

- Outstanding Job Placement: 90% of ORU accounting graduates secure jobs before graduation.

Join a program designed to empower you to lead with purpose and make a difference in the financial world. Start your journey at ORU today!

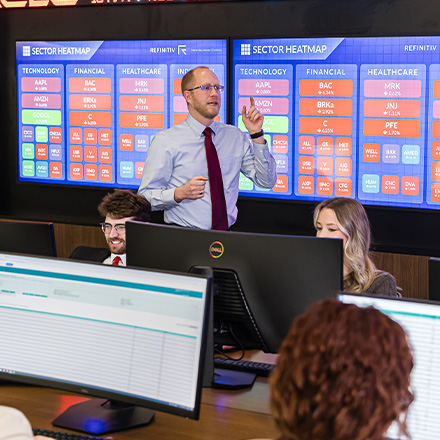

Experience hands-on learning, face-to-face interaction, and vibrant community life

at our main campus. Join live, scheduled classes online with real-time interaction and a structured learning

environment. Access coursework anytime, anywhere—perfect for self-paced learning and flexible schedules.Flexible Study Options

ON CAMPUS

ORU FLEX

ONLINE

ORU has helped me gain confidence and knowledge, not just for the CPA exam, but for a future career in accounting.

Cole Kraai (Student)

Michigan

ACCOUNTING Courses Offered

As an ORU accounting student, you’ll gain expertise in key areas of the field, including:

- Financial Accounting

- Quantitative Analysis

- Auditing

- Federal Income Tax Accounting

- Managerial Accounting

- Accounting Information Systems

- Estate and Gift Taxation

Degree Path

Nearly 100% of our full-time, undergraduate residential students receive ORU grants

and scholarships through academic achievement and through ORU’s premier Quest Whole

Leader Scholarship. To learn more about financial aid, click here.Tuition and Scholarships

Careers with an Accounting Degree

ORU accounting graduates can enjoy a successful career as a:

- Financial Analyst

- Consultant or Tax Advisor

- Government Accountant

- Private Financial Advisor

- Public Accountant

- Industry or Business Accountant

The qualities demonstrated by ORU graduates leave employers asking, "How many more can you send me?"

Employer

Program Features

How it works:

The ORU accounting pathway meets CPA exam academic requirements in 46 U.S. states.

Kansas has an additional requirement of 11 credit hours in communication courses—ORU

accounting majors complete six, but can fulfill the remaining hours through elective

courses in the Communication Department.

Exceptions:

Fast Track Program

At ORU, you’ll learn from faith-driven professionals who understand what it takes

to succeed in today’s global business world. Our faculty is dedicated to helping you

lead with purpose, integrity, and excellence in your career.MEET YOUR FACULTY